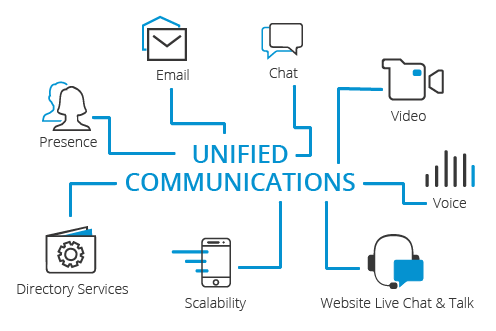

Well, UCC has completely changed now! It has evolved much more than “Just Voice”.

I remember, few years ago, when I was part of CUCM team in Cisco TAC, voice was everything. Customers did not put much focus on Video, Mobility (anytime, anywhere device), Seamless Experience for a remote/ hybrid user etc. Now these are the current trends. But, as you are aware there have been many reasons to the change in mindset.

In this blog, we will explore the External Factors causing change in Customer Demands and my own experiences working with some of these customers.

Before we begin deliberation on Unified Communication in 2022, it’s vital to understand the current industry trends, hear from industry experts and understand user behaviour. At it’s very core, we need to understand what is causing the industry to change.

External Influencing Factors

When I think about this, many thoughts cross my mind.

- Covid Period. In my opinion, more than the change itself, everybody had to adopt it immediately (which itself was a big change) on how we work. First it went from being in office (pre-2020) to complete remote(2020-21), and now from remote to Hybrid (2022+)

- Due to scale and speed of Cloud adoption, various challenges were unearthed for which new permanent solutions are being created.

- User Expectations/ Demands and Behaviour – First, The Great Resignation and then, The Great Reshuffle & now, Hybrid or Remote Work expectation.

- Seamless, Consistent experience for a user remotely vs in office.

- Supply Shortage Issues

- Russia Ukraine War and other Geo Political Concerns

- Environment Protection and Enhancement – Sustainability Movements and NetCarbonZero targets.

These are some of the key reasons why Unified Communication and Collaboration industry has changed completely and will continue to do so.

“Change meets Expectations while Expectations meets Change”

Ronak Agarwal

Obviously knowing just the external factors is partial knowledge., it makes sense to also see customer demands that have changed.

Customer Needs are CONVERGING!

- Customers are not buying product/ licenses in Silos.

- Customers prefer as a service model instead of product and services as 2 separate bundles.

- Heterogenous products need to work together.

- Customers want Clear Investment Visibility and ability to forecast expenses.

- Proactive Troubleshooting and fixes

- Voice AI/ Conversational AI functionality in the UC Platform

- Personalisation & Contextualisation of Services

- Now that we (employees and employers) know Remote and Hybrid work “Works” and there is no looking back.

Now, these “External Factors” and “Customer Demands” have given rise to “UCC Trends” and are shaping the future. Let’s look at some of them.

Demand Trends

- Hybrid Work/ Flexible Work has given rise to Workplace Redesign/ Transformation Initiatives. Thinking more about Digital Office Setup.

- Increasing Adoption of Video First Collaboration and Contact Center Solutions.

- Decrease in UCC On prem hardware including phones, servers etc. However, this has given rise to increase in headphones.

- API Integration (No Code, Low Code tools), NLP, Conversational AI

- Digital Wellbeing Management

- “End User Experience” is the theme of a solution instead of previously typecasted “Infrastructure”

- Metaverse

- As a service model for anything and everything. For eg, SBC as a Service, Meeting Room as a service, Direct Routing as a service etc. You get the point.

- On top of this, Security matters the most.

UCC Technology is not just for IT companies, it’s for all and every Sector.

Ronak Agarwal

From a UCC technology perspective, it is about Voice, Video & Collaboration (instance messaging, file share, group conversations etc.) Let’s qualify What & How a Next Gen UC Solution should look like.

Technology Perspective

For a Next Generation UCC Solution, you should look for below attributes and qualify:

- Cloud Subscription Based Services

- Interop driven solution for heterogenous environment

- Personalized experiences considering the User Persona

- Converged Tech

- Support for Multi-media especially Video First Communication

- Integration with Conversational Bots (AI, NLP etc.) or Business Workflow Integrations

- Consolidated Backend Circuit/ SIP Consolidation

Well, till now I hope you get a sense of how rapidly technology is changing and how urgently you need to explore and learn. For people who have been working in this area for over 10 years, it is time to “as we say” Unlearn. Learn.Relearn

Now, let’s look at the Market players providing these services.

Market Players

After reading till now, I am sure you are interested to know the UCaaS & Meeting Room Services platform leaders globally.

As per Gartner, “Microsoft” “RingCentral” “Cisco” “Zoom” “8×8” as leaders for UCaaS and “Microsoft” “Cisco” “Zoom” for Meeting Room Solutions.

As per UCToday, it qualifies these 10 OEM for UCaaS platform:

- Cisco

- 8×8

- RingCentral

- Zoom

- Dialpad

- Vonage

- GoTo

- Microsoft

- Sangoma

Currently, many large OEM’s are also acquiring other companies to strength their global reach, improve their capability etc. Let’s look at some of these acquisitions.

Acquisitions

- Ericsson announced an acquisition of Vonage.

- RingCentral and Mitel

- 8×8 announcing a strategic buyout of enterprise contact center FUZE

- Cloudli Communications acquired ConnectMeVoice

- Sangoma acquired NetFortis for UCaaS and MSP expertise

- European technology distributor Nuvias UC acquired Alliance Technologies

- UCaaS provider Inflow Communications acquired EPIC Connections, a contact center consultancy.

- BCM One acquired CoreDial

- Broadvoice acquired GoContact

- BCM One acquired Wholesale Carrier Services (WCS)

- Zoom acquired Kites for real-time language translation software.

- Unisys acquired Unify Square , a combination software company, MSP and Unified Communications as a Service (UCaaS) consulting company focused on Microsoft Teams and Zoom Video Communications

- Sangoma acquired Star2Star for expanded UCaaS services worldwide.

- BCM One acquired SkySwitch to expand its UCaaS expertise.

- Crestline invested in Broadvoice to expand UCaaS and contact center as-a-service (CCaaS) markets.

- Private investment firm Searchlight Capital Partners and private equity firm Abry Partners launched a standalone UCaaS company called Clearspan.

- Intrado, backed by private equity firm Apollo, acquired ONSip for UCaaS capabilities.

- Lifesize and Serenova merged, backed by private equity firm Marlin Equity Partners,

- Sverica Capital Management acquired Cytracom, which promotes UCaaS to MSPs.

- Comcast acquired Blueface for UCaaS.

- Lingo Communications, a cloud & MSP focused on SMB unified communications, acquired selected customers from Blue Casa Telephone.

- BCM One acquired UCaaS provider Arena One

- Digerati Technologies, a UCaaS provider, acquired Miami-based Nexogy for cloud communication and broadband solutions.

- RingCentral invested in Avaya.

- Searchlight Capital Partners acquired Mitel and its ShoreTel business for $2 billion.

There has never been such exiting times before and is a wonderful time to learn and grow.

Ronak Agarwal

Well, it’s important to understand what OEM’s are doing and keeping oneself updated.

That’s it Folks! Let me know what you think about the blog. Please share and do comment your thoughts. I am always interested to know different perspectives and learn from you. Please post for any questions, comments. I can also be reached at LinkedIn, Twitter, Facebook.

A enthusiast technical blogger, speaker, writer and have an interest in learning & sharing new capabilities.

I work as a Digital Workplace Consultant, with a primary focus on Microsoft Teams, Cisco Telephony, Zoom, Office 365, Azure.

Like to talk about #FutureOfCollaboration #AgileManagedServices #AI, #UCAAS #WorkplaceTransformation #HybridWorkplace #WXC #TimeManagement #Productivity

Professionally, I am an Experienced Digital Communication and Workplace Transformation Consultant.

Total Experience of over 10 years. Currently leading a UC Presales Team and based out of London, UK. Responsible for consulting EN and NN customers on:

• Continued Innovation & Automation potential by data analytics.

• Solution transformation or Platform Harmonization approach.

• Potential of transforming traditional Managed Operations to Next Gen Agile Ops.

• Helping customers understand importance of experience transformation(CX) and technology adoption.

Apart from this, I have interests in Spirituality, Finance & Investments, Physical Sports and currently based out of London, UK.